- Article

- 4 min read

The key to a happy life isn't just about money,

it’s about mindset.

Eat out, or stay at home? Stay in a safe job, or chase your dream? Pay into your ISA, or splurge on the holiday of a lifetime?

Spoiler alert: they're all the answer to a happy, long life.

Every money decision you make affects you both today, and tomorrow. And, we get it, dealing with finances can feel scary – especially when even talking about money is seen as taboo.

Money:Mindshift is here to help you with balancing what's in your bank, with what's on your mind. Helping you feel empowered, not overwhelmed, when it comes to dealing with (and talking about) money.

The Money:Mindshift podcast

What if we told you that it’s your mindset that matters most when it comes to finances?

In our podcast, host Dr. Tom speaks to experts about how to make a mindshift when it comes to money – for the better. Think of it as looking after both yourself today, and future-you.

Money:Mindshift is here to help you lead a more fulfilled and meaningful life.

With joy and purpose at the forefront.

Welcome to your money safe space. Here you’ll find tips and tools through engaging articles and insightful podcast episodes to help you live a happier, longer life.

Backed by Aegon and led by Dr. Thomas Mathar (or Dr. Tom, for short) – a podcast host, author and financial wellbeing pro – Money:Mindshift will help you make thoughtful decisions so you feel happier with what you have. Both today, and tomorrow (even if you're not thinking about the future just yet).

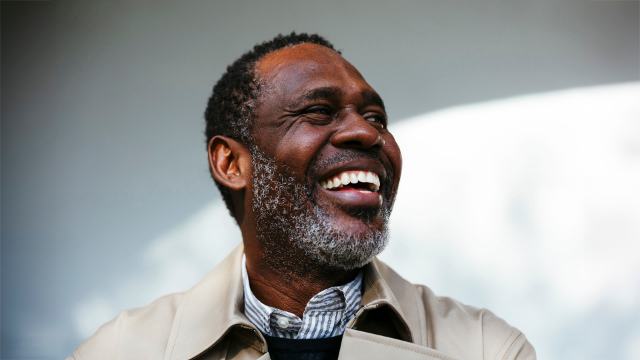

Dr. Tom is here to help

An author, podcast host, and speaker on all things financial wellbeing, Dr Thomas Mathar (or Dr. Tom, as we call him) has a unique drive to help you live a happy, long and richer life.

Money:Mindshift blends trusted expertise with human insight to make finances accessible, engaging and practical. Because we get it: money worries can feel overwhelming. We're here to make you feel empowered when it comes to dealing with your finances, instead.

Pick up positive new habits on the Money:Mindshift podcast, and check out Dr. Tom's new book: ‘Your Path to Prosperity: How to fund a happy and long life'.

Tools and resources

To balance both our financial responsibilities and our mindset, we all have to get to know our emotions, motivations, and hopes for the future.

Check out our handy tools and resources on how Money:Mindshift can help you do just that.

First thing's first: what's your money personality?

Take our quick money personality quiz, then explore our tools and resources to help you plan with your results in mind.

Which personality type are you?

Which personality type feels most like you? You might relate to more than one, but recognising your values and behaviours can help you plan in a way that fits.

Read our financial wellbeing index

Our financial wellbeing guide is designed to help you understand more about financial wellbeing, why it’s important, and actions you could take to improve your mindset when it comes to money.

What does your best life look like?

The first step to getting prepared for your future is to picture what your life could look like - as well as recognising the steps you might need to take to get there.

Become more in tune with your future self with our Best Life Tool and understand how to make the best decisions today for your unique vision of tomorrow.

Check out our Second 50 report

Life doesn't stop at retirement. We’ve recently launched the second edition of our Second 50 report – designed to explore what a longer life could mean for you.

Are you concerned about the cost-of-living crisis, global events and market volatility? We have lots of support available to help you.

You can view all our supporting material on cost of living on our Cost of living support page.

View our financial wellbeing guide

Looking for more information or support? Head over to our dedicated financial wellbeing guide.

Articles for you

Living a happy, long life is about finding out what makes you tick, investing in what brings you joy, and spending time with the people you love.

Check out our latest articles below to learn more about how to balance your financial responsibilities with your mindset – for the better.