Our value-focussed Risk-Managed Portfolios let you access a complete portfolio of investments in a single fund. You can use them in your pension, individual savings account (ISA) or general investment account (GIA). And with six funds to choose from, you can select a risk level that you're comfortable with.

You can choose from six Risk-Managed Portfolios, each of which is designed to match a different risk preference. Click on the portfolios below to find out more about each fund.

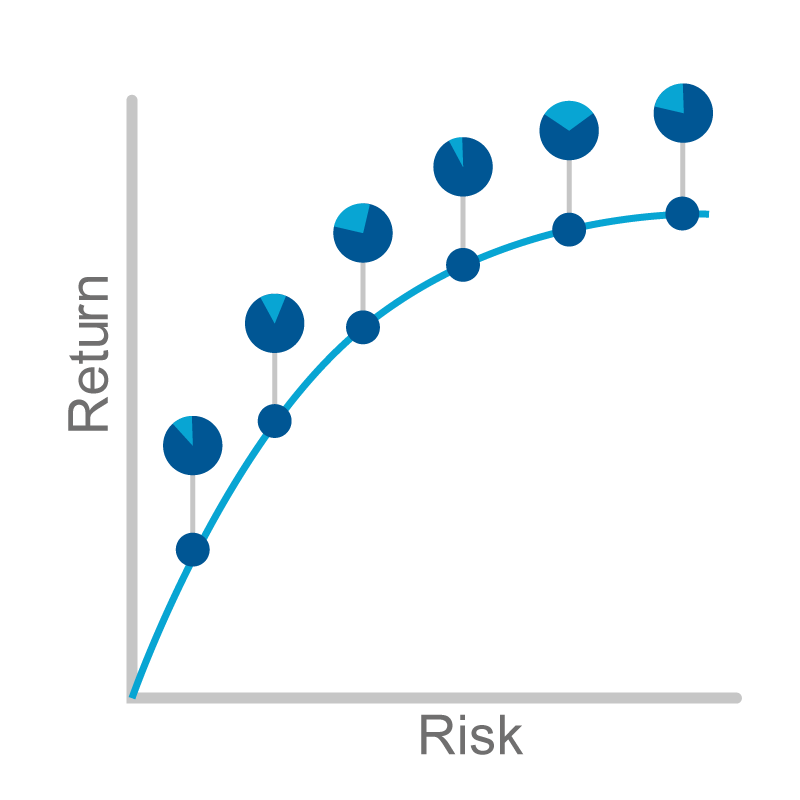

Generally, you'd expect higher-risk funds to return more over the longer term than lower-risk funds, but there's no guarantee of this and there's a greater chance they could lose money, particularly over shorter time periods.

Benefits of our Risk-Managed Portfolios:

- Let you choose the balance of risk and long-term growth potential that’s right for you

- Available within a pension, ISA or GIA

- Managed on your behalf – we monitor the portfolios and change them if needed

- Provide a complete, risk-managed portfolio for an ongoing fund charge of 0.25% each year*

- Are backed by our Funds Promise, which means their performance is monitored by our Fund Governance Group

* As at December 2024. Transaction charges and a platform fee will also apply.

Documents

There's no guarantee the funds will meet their objectives. Their value can go down as well as up and isn't guaranteed. You could get back less than you invested. Before making any decision to invest in a particular fund, you should read the fund factsheets and Key investor information documents for full details on the fund, including risks and charges, which you can find under the 'Risk Managed range' tab above.

How our Risk-Managed Portfolios work

Risk management

We monitor risks at every stage of the investment process. For example, we assess how market factors, such as interest rate changes, government spending and trade disputes, might impact the portfolios over the long term. We then make adjustments to the asset allocation – the mix of equities (shares), bonds and cash – with the aim of making sure each portfolio keeps to its risk level.

Active asset allocation

Asset allocation is key, not just to managing risk, but for the growth potential of each portfolio. Our Portfolio Management team works with investment specialists Aon* to create and maintain a mix of investments that it believes will deliver the best returns possible for each risk level.

Passively managed components

The portfolios use passively managed investments, also known as tracker funds. Passive investments aim to produce returns broadly in line with the markets they track (before charges) by investing in the same investments in the same proportions, as their benchmark. This approach means less manual intervention, keeping charges low.

Monitoring

Because the portfolios are backed by our Funds Promise, we check them regularly to see if they're meeting their objectives. That means:

- We check to see whether the funds the portfolios invest in, as well as the overall portfolios, are performing as expected.

- We will change the mix, remove or add funds if they're not.

Our Funds Promise

We regularly check these funds with the aim of making sure they're meeting their objectives. Find out more.

*Aon replaced Morningstar as our asset allocation consultants on 1 Jan 2023.

Waystone Management (UK) Limited (WS) is the authorised corporate director of the WS Aegon Risk-Managed Funds. This means they're responsible for the operation of the funds in accordance with the regulations.