- Article

- 6 min read

Your workplace pension

As part of your employment, you'll regularly pay into a workplace pension, with your employer also making contributions. These contributions are invested to help grow your savings for retirement. You have the freedom to choose how your savings are invested. We aim to offer a range of investment options to support you and help you make the decisions that are right for you.

Investing in a default fund

If you don't choose where to invest your pension, you'll automatically be invested in your scheme's default fund. This fund is designed to manage your investments from the moment you join your scheme through to retirement. Default funds may not suit everyone as they don't consider individual circumstances or retirement plans. The alternative to investing in a default fund is to choose your own investments from within our offered range. Just keep in mind that not all funds are managed for you, so you may need to monitor them yourself.

To see where your pension is currently invested, log in to your TargetPlan account and select View and manage. It’s especially important to review your investments as you approach retirement, in case you want to change how or when you take your savings.

How Aegon LifePath funds work

The Aegon LifePath funds are target dated funds, meaning they automatically adjust what they invest in as you get closer to retirement. Early on, they focus on investing in assets designed to grow your savings. As retirement approaches, they shift to invest in assets which are typically considered to be lower-risk, aiming to preserve the savings you’ve built up. These funds invest across a mix of assets, like equities and bonds and in different world regions. This approach, called diversification, helps spread risk by not putting all your eggs in one basket.

If you invest in Aegon LifePath, you’ll be put into a fund that is managed in line with the year you plan to retire and it will include the name of the year in the fund name. For example, if you plan to retire in 2035, you’ll be put into a fund that has 2034 – 2036 in its name.

Grow

In your early working years, the fund focuses on growing your pension savings. Your money is mainly invested in equities (company shares), which carry more risk but typically offer greater potential for long-term growth.

Preserve

As you get closer to retirement, the fund gradually moves your savings into investments that are considered lower-risk, like bonds. This aims to help protect the savings you’ve built up. This shift, known as de-risking, starts 15 years before your chosen retirement age.

Access

What happens to your savings once you’ve reached your target retirement age and how you access them will depend on the specific Aegon LifePath fund you’re invested.

How Aegon LifePath funds are invested

There are three Aegon LifePath funds to choose from - Flexi, Retirement, and Capital. They all follow the same investment approach, but are designed to support different ways of accessing your pension when you retire. It's important you choose the fund which aligns with your retirement goals. It's quick and easy to make changes through your TargetPlan online account.

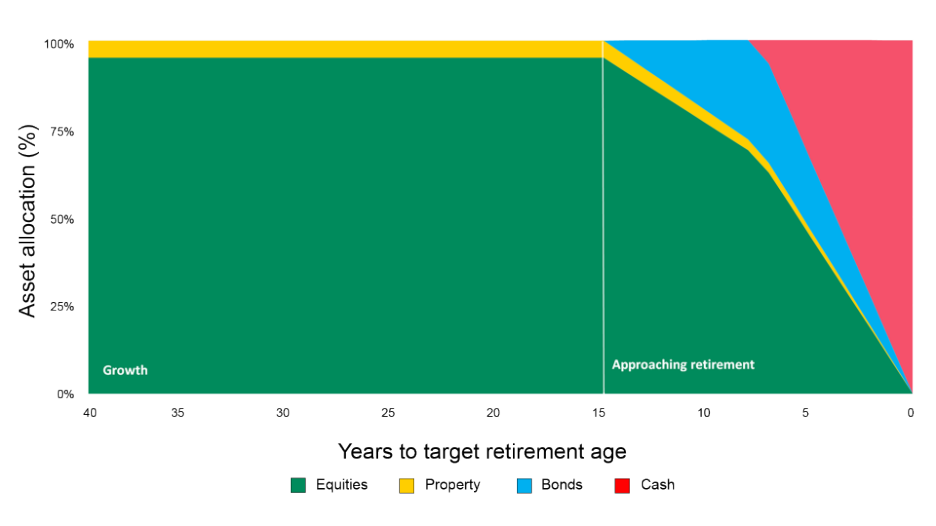

Aegon LifePath Flexi is designed for people who plan to stay invested after they retire, with a view to taking an income flexibly, this approach is known as income drawdown.

Early on, the fund invests 100% of your savings in assets designed to grow your pot. 15 years before your target retirement age, the fund automatically shifts to invest more in assets that are considered to be lower-risk, aiming to preserve the pot you have built up. By your target retirement age, the fund aims to hold around 40% in global equities and 60% in fixed income securities and it keeps that balance into retirement.

This fund assumes you want to stay invested in retirement and draw an income from your savings. This means the value of your savings and any income isn’t guaranteed and may fall as well as rise in value. You could run out of money. Moving into lower-risk investments could also mean you miss out on some growth if markets go up.

The image below shows how the Aegon LifePath Flexi fund automatically changes what you’re invested in as you get closer to your target retirement age.

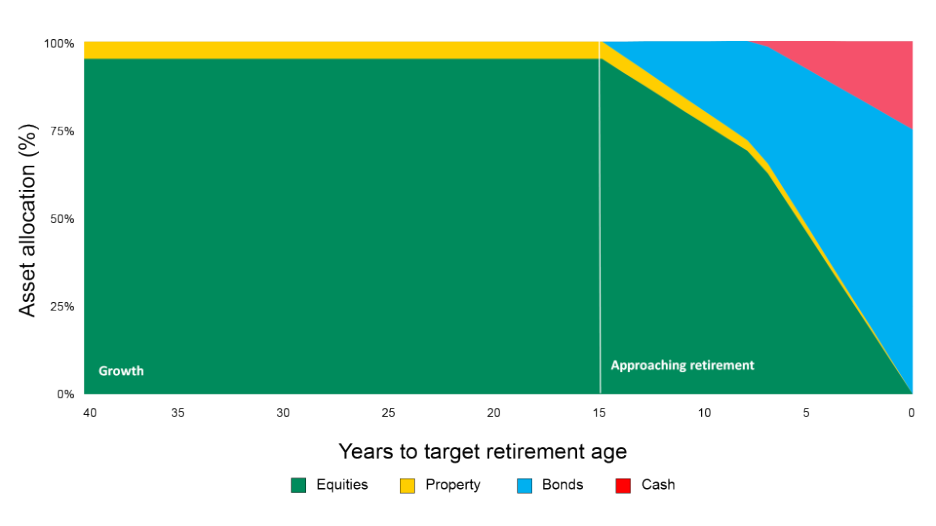

Aegon LifePath Retirement is for people who want to turn their savings into a lifelong regular income by purchasing an annuity.

Early on, the fund invests 100% of your savings in assets designed to grow your pot. 15 years before your target retirement age, the fund automatically shifts to invest more in assets which are considered to be lower-risk, aiming to preserve the pot you have built up. By your target retirement age, the fund aims to hold around 75% in fixed income securities (such as bonds) and 25% in a cash fund.

This mix aims to ensure that, even if the value of your retirement savings goes down just before you retire, the size of annuity you can buy should stay broadly the same, although this isn’t guaranteed. It also allows you to withdraw up to 25% of your retirement savings tax free. This information is based on our understanding of current taxation law and HMRC practice, which may change.

The fund isn't meant for long-term investing post-retirement. The value of your savings and any income isn't guaranteed and may fall as well as rise. The diagram below shows how the fund gradually changes its investment mix as you approach retirement.

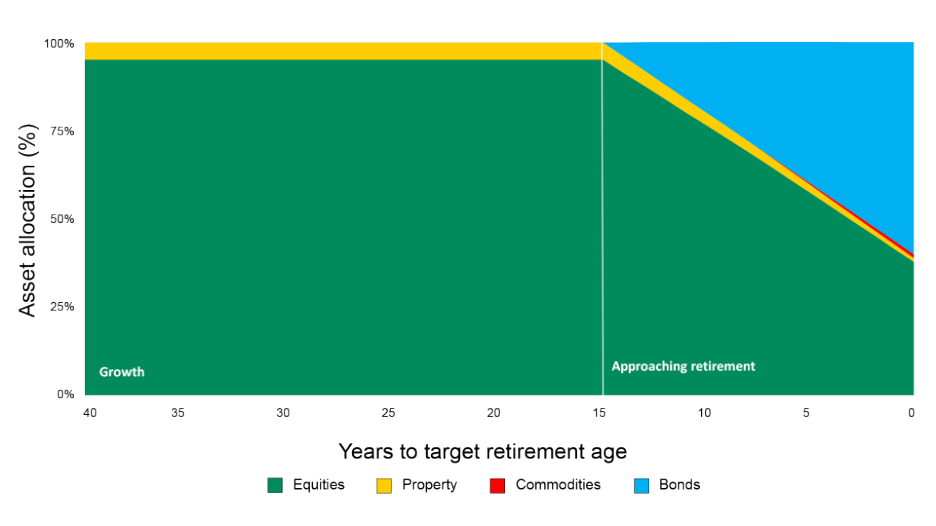

Aegon LifePath Capital is for people who intend to take their entire pension pot as a cash lump sum at retirement.

Early on, the fund invests 100% of your savings in assets designed to grow your pot. 15 years before your target retirement age, the fund automatically shifts to invest more in assets which are considered to be lower-risk, aiming to preserve the pot you have built up. By your target retirement age, the fund aims to hold around 100% in a cash fund.

The fund isn't designed for long-term investing post-retirement. The value of your savings and any income isn't guaranteed and may fall as well as rise. The diagram below shows how the fund gradually changes its investment mix as you approach retirement.