Background

The default investment strategy is changing from the Aegon LifePath Flexi Strategy to the BlackRock Retirement Savings Plan Default Strategy. This will be made up of two funds: the Growth Fund and the Retirement Fund (both are bespoke funds only available as part of the new default strategy), which will be combined to create a strategy based on the year you intend to retire. If you change your target retirement age, the strategy adapts accordingly, which is consistent with the current default strategy.

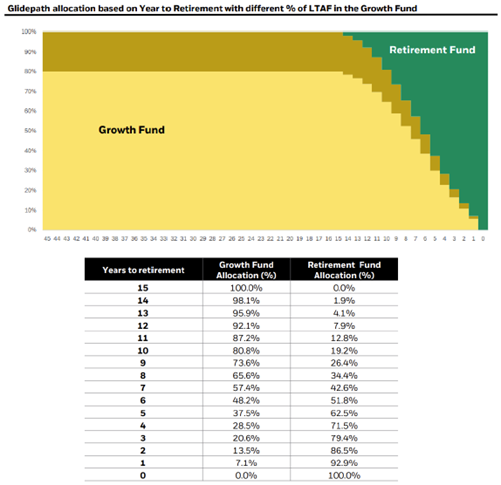

The Growth Fund will include an allocation to the BlackRock Long-Term Asset Fund (LTAF) and will target investing predominantly in private market assets, aiming to improve employee outcomes and provide diversification benefits. The BlackRock Retirement Savings Plan Default Strategy will target a 20% investment in the BlackRock LTAF for employees more than 15 years from target retirement age (gradually reducing as retirement approaches). The strategy features a 15-year glidepath that aims to gradually reduce investment risk as you approach retirement, moving your investments from the Growth Fund to the Retirement Fund.

BlackRock has also agreed to remove all ongoing charges associated with investing in the BlackRock Retirement Savings Plan Default Strategy. This is a significant improvement for members compared to the current 0.26% annual management charge on the existing default strategy with Aegon. This will result in the best possible retirement outcomes for employees, as all of your pension contributions will be invested for growth.

The BlackRock UK Council carefully design and oversee the default investment strategy to ensure it aligns with employees’ best interests, aiming to balance growth potential with risk management. The Council have conducted a strategic review and decided to adapt the strategy to meet regulatory standards, the evolving market and your needs. Following this review, the new strategy has been designed to better suit employees' needs and aims to improve risk-adjusted returns – this is how much profit an investment makes compared to the amount of risk or uncertainty involved in making that profit.

Aegon unilaterally made changes to the Plan’s default strategy in mid-2025 (you were provided with information on these at the time of the changes). Under the new strategy going forward, the strategic asset allocation will be set by the BlackRock UK Pension Council, who aim to provide a bespoke default strategy that will result in the best possible retirement outcomes for BlackRock employees specifically.

The BlackRock UK Pension Council plays a vital role in overseeing our BlackRock Retirement Savings Plan to ensure it meets both the Company’s and employees’ needs effectively and compliantly. It provides clear oversight of the Plan’s operation, ensuring it remains simple, accessible, and aligned with our commitment to offering competitive retirement benefits. The Council also monitors compliance with relevant regulations and the performance of our pension provider, helping to safeguard your retirement savings and support the Company’s objectives. The Council is comprised of senior leaders from HR, Legal, Investment and BlackRock Executive teams.

The transition will take place on April 1, 2026.

What does this change mean for you?

Members currently invested in the default Aegon LifePath Flexi Strategy will be automatically moved to the new BlackRock Retirement Savings Plan Default Strategy.

If you would prefer to remain in the Aegon LifePath Flexi Strategy, you must opt out before the transition. More information on how to opt out will be provided in February. Please note that if you remain invested in the current default strategy, charges will apply as usual.

Yes, if you choose to remain in the Aegon LifePath Flexi Strategy by opting out initially, you will still have the option to transfer your investments to the new BlackRock Retirement Savings Plan Default Strategy at a later date.

You will remain invested as you currently are, but you can choose to switch your investment option to the new default strategy once available (see question below).

Yes, once the new default strategy is available you can choose to invest in the new default strategy and can switch your investments online via your TargetPlan account (see question 16 for more details on how to do this).

No. BlackRock will cover all expenses related to the new default strategy, including transaction costs for moving investments. On an ongoing basis, there will be no annual management charge.

Yes, self-select funds remain available, but they currently carry an annual management charge determined by the specific fund chosen.

No. Due to regulatory restrictions, neither the Growth Fund nor the BlackRock LTAF can be offered as self-select funds at this time. However, this position will be monitored and we will let you know if this changes.

Yes. The default strategy will be available as an investment option alongside the existing self-select funds available in the Plan. You can select the default strategy following the blackout period from March 23 to April 3, 2026.

Yes, to implement the transition smoothly, there will be a ‘freeze’ or ‘blackout’ period during which you won’t be able to make changes to your pension account, such as switching funds, transferring benefits, or taking retirement benefits. This period ensures the move to the new default strategy is completed accurately and securely. Exact dates will be shared when we write to you in February 2026.

If you’re close to retirement or thinking of transferring your retirement benefits out of the Plan imminently, please contact Aegon to discuss timings and any impact of the freeze period – see question 20 for contact details.

You can check how your contributions in the Plan are currently invested by going to the pension member website at aegon.co.uk/targetplan

Sign in to your TargetPlan account and from your dashboard select View and manage – this will take you to your pension summary page so you can:

- See your current investments: this is towards the bottom of the page in the section titled Your investment allocation

- Find fund information, including details of charges and links to fund factsheets: select Fund information under More options

The glidepath will use two funds – the Growth Fund (which will include an allocation to the BlackRock LTAF – targeted at 20%) and the Retirement Fund. As you approach your target retirement age, allocations in the funds adjust to gradually reduce your investment risk, as shown below:

The Growth Fund within the new default strategy has a target allocation of 20% to the BlackRock LTAF, which invests in private markets. Because private market investments take time to build up, this 20% allocation will be phased in gradually over time, rather than applied all at once.

The new default strategy invests in private markets, which means it can be harder to sell these investments quickly and their value might be less certain compared to investments you can buy and sell on the stock market. However, the fund mitigates these risks by spreading money across different types of investments, carefully managing how easily it can access cash, and using a mix of investment types. It also means that the values of these assets are typically less volatile than publicly traded securities.

Further information and financial advice

More information will be available soon, and we will write to you in February 2026 with everything you need to know about the changes.

If you have any immediate queries, you can contact Aegon’s customer helpline on 01733 353 490, or email my.pension@aegon.co.uk for assistance.

BlackRock employees have access to Brooks Financial for investment guidance. Contact Brooks for a free one-to-one today by emailing BlackRock@Brooks-Financial.com

Neither BlackRock, the Council of the BlackRock Retirement Savings Plan, nor Aegon are authorised to give you financial advice. If you need help finding an independent financial adviser, you can visit the Financial Conduct Authority website at www.fca.org.uk or MoneyHelper at https://www.moneyhelper.org.uk/en/getting-help-and-advice/financial-advisers/choosing-a-financial-adviser.

Yes, information sessions will be made available to help you understand the changes and what they mean for your investments. Details of how to access these sessions will be provided in February. Further information will also be available at the benefits fairs in March.