Annuity Target funds are designed for pension scheme members who will buy an annuity - which is a guaranteed income for life - when they reach retirement.

There are two main stages:

Growth - when you're still some way from retirement.

At this stage the funds invest in a mix of investments designed to grow your pension pot.

You are able to choose the fund that best meets your savings needs and attitude to risk.

Retirement target - when you're approaching retirement.

In the final years before your target retirement age, we automatically start to prepare your pension savings to buy an annuity at retirement.

We’ll gradually move your savings out of their growth stage investments into those considered to be lower risk, such as fixed interest (bonds) and long gilts (UK government bonds). The aim is to ensure we do as much as we can to preserve the size of annuity you're able to buy.

When you're approaching your target retirement age, we'll also move 25% into cash to cater for your tax-free cash entitlement. You can currently take up to 25% of your pension pot as tax-free cash. This is based on our understanding of current taxation law and HMRC practice, which may change.

The value of investments in the growth and retirement target stages can fall as well as rise and isn't guaranteed. The value of your pension pot when you come to take benefits may be less than has been paid in.

Why we use long gilts

If the value of long gilts goes down, annuity rates tend to go up. This means that whilst the value of your pension pot may fall, what that pot will buy in terms of an annual income in the annuity, tends to go up.

Likewise, if the value of long gilts goes up, annuity rates tend to fall. This means that while your pension pot may go up in value, what it will buy as an annuity tends to go down.

So if the value of your pension pot fluctuates just before you retire, you should be able to buy roughly the same size annual income through the annuity - although this relationship isn't perfect and is not guaranteed.

Your savings may also be moved into other types of fixed interest investments that are considered lower risk and cash in the retirement target stage. For example, where market conditions suggest that doing so would best help preserve the value of annuity you would be able to buy at retirement.

An example

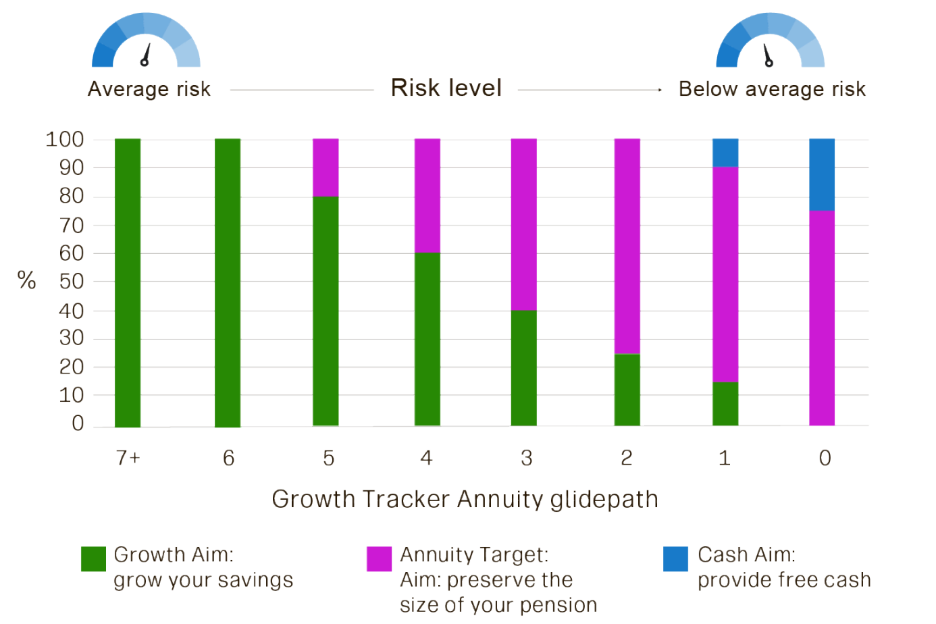

Here's an example of how the fund changes in the years before you retire:

Please note that this is just an example, some of our lifestyle funds have different starting risk levels and will move into investments designed to preserve your annuity buying power and cash at slightly different times.

Important information

The risk levels shown here are Aegon's and shouldn't be compared to any other providers' risk ratings.

The fund moves into fixed interest investments and cash to try to neutralise the effects of interest rates on the annuity you can buy at retirement. The value of the fund at retirement can still fall as well as rise and isn't guaranteed. If you don't buy an annuity at retirement, returns may not keep pace with inflation over the long term.

We review these funds regularly and may change them if we believe it’s in the best interests of investors.

The choice is yours

Annuity target and lifestyle funds are designed for use by workplace pension schemes. If an employer selects it as their scheme's default fund, members who don't make their own fund selection will be automatically invested into it when they join their workplace pension scheme. This means they're invested from day one.

Your employer will have chosen it because they think it best meets the average needs of their workforce, and because they think that most members plan to buy an annuity on retirement. However, it may not be the best fit for you.

If you want more control over where your money is invested, you can select a fund that's more tailored to your needs. If so, please review our other investment options.

You should speak to a financial adviser in the first instance if you need advice about your investments. If you don't have a financial adviser, you can find one in your area by visiting MoneyHelper, or find out more about advice services supported by Aegon by visiting Origen.

Origen Financial Services Ltd is wholly owned by Aegon UK plc but operate independently to us.