Aegon LifePath Funds are designed to manage saving for retirement within a single, long-term investment. As the common default investment option for TargetPlan and Aegon Master Trust schemes, LifePath offers a ready-made solution with flexible options at retirement.

How Aegon LifePath funds work

Aegon LifePath funds are target date funds designed to automatically adjust their investment strategy as a member approaches retirement. Early in their career, the fund focuses on growth, investing in assets like equities to help build long-term savings. As retirement nears, the fund gradually shifts towards investments that are considered lower-risk , such as bonds, to help preserve the accumulated savings.

These LifePath funds are diversified, investing across a range of asset types and global regions. This helps manage risk by avoiding over-reliance on any single investment type or market.

Members will be placed into a LifePath fund aligned with their expected retirement year. For example, someone planning to retire in 2035 would typically be invested in a fund named LifePath 2034–2036.

Grow

Up until 15 years before retirement, the fund is fully allocated to equities and equity-like assets, aiming to maximise long-term growth potential. This allocation is diversified across global, developed and emerging markets and fully integrates Environmental, Social, and Governance (ESG) considerations throughout the growth phase.

Preserve

As retirement approaches, the fund gradually moves towards a more conservative asset allocation. From 15 years before retirement, the portfolio gradually reduces equity exposure, investing more in investments that are considered lower-risk, like bonds, aimed at helping to preserve the value of accumulated savings.

Access

At retirement, members have flexible options for accessing their savings. Depending on the specific Aegon LifePath fund they’re invested in, they may choose from drawdown, annuity, or cash withdrawal options. This flexibility allows members to tailor their retirement income strategy to suit their individual needs and circumstances.

Unlocking innovative investment opportunities

From 2026, Aegon LifePath funds will also begin to invest in private markets, providing access to new investment opportunities previously out of reach for workplace savers, including investments in breakthrough companies that fuel innovation and growth across the wider economy. This change aims to increase diversification and deliver better value.

Find out more by reading our fund update.

Offering choice and flexibility at retirement

There are three Aegon LifePath funds to choose from - Flexi, Retirement, and Capital. They all follow the same investment approach but are designed to support different ways for members to access their savings when they retire.

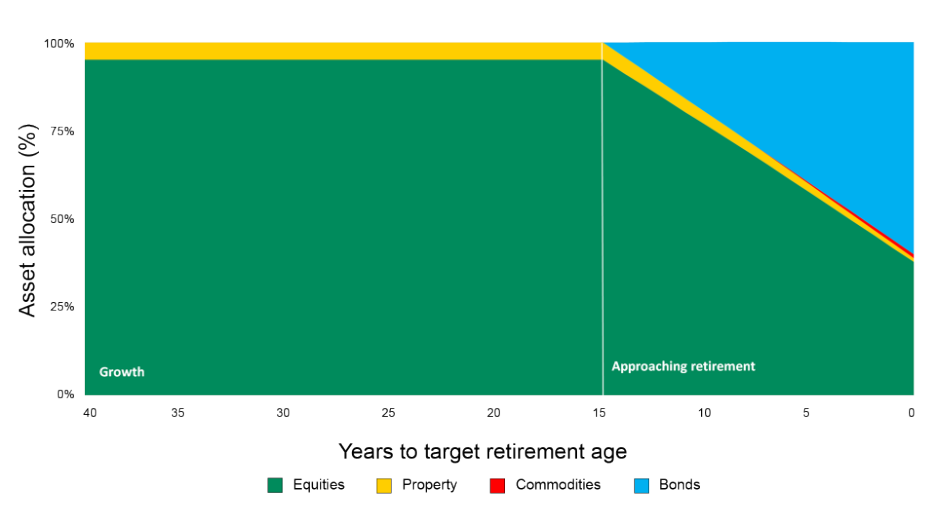

Aegon LifePath Flexi is designed for members who plan to stay invested after they retire, with a view to taking an income flexibly, this approach is known as income drawdown.

Early on in their career, the fund invests 100% of savings in assets designed to grow a pension. 15 years before a member’s target retirement age, the fund automatically shifts into invest more in assets which are considered to be lower-risk, aiming to preserve the pot that has been built up. At retirement, the fund aims to hold around 40% in global equities and 60% in fixed income securities maintaining that allocation through retirement.

This fund assumes that a member wants to stay invested in retirement and draw an income from savings. This means the value of savings and any income isn’t guaranteed and may fall as well as rise in value. Investors in this fund could run out of money. Moving into investments considered lower-risk could also mean missing out on some growth if markets go up. The diagram below shows how the fund gradually changes its asset allocation.

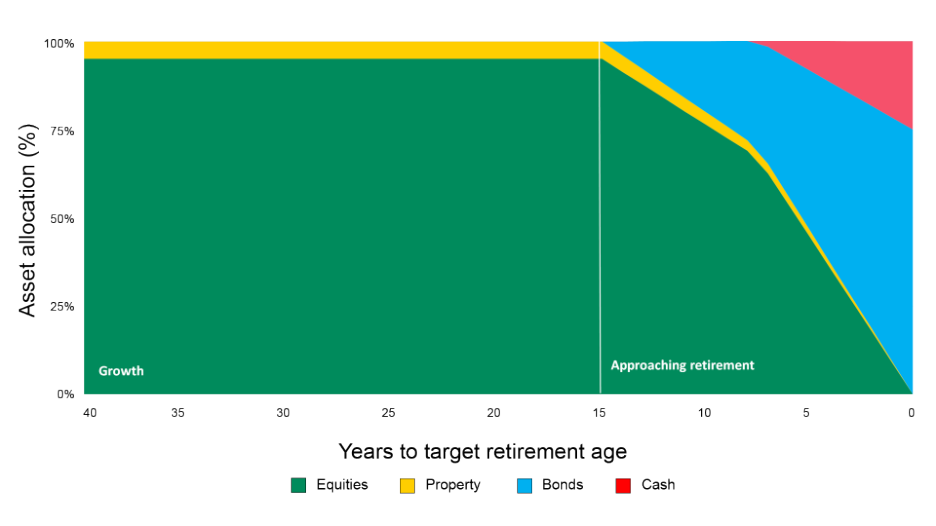

Aegon LifePath Retirement is for members who want to turn their savings into a lifelong regular income by purchasing an annuity.

Early on, the fund invests 100% of savings in assets designed to grow a pension. 15 years before target retirement age, the fund automatically shifts to invest more in assets which are considered to be lower-risk, aiming to preserve the pot that has been built up. At retirement, the fund aims to hold around 75% in fixed income securities (such as bonds) and 25% in a cash fund.

This mix aims to ensure that, even if the value of your retirement savings goes down just before retirement, the size of annuity should stay broadly the same, although this isn’t guaranteed. It also allows investors to withdraw up to 25% of retirement savings tax free. This information is based on our understanding of current taxation law and HMRC practice, which may change.

The fund isn't meant for long-term investing post-retirement. The value of savings and any income isn't guaranteed and may fall as well as rise.

The diagram below shows how the fund gradually changes its asset allocation.

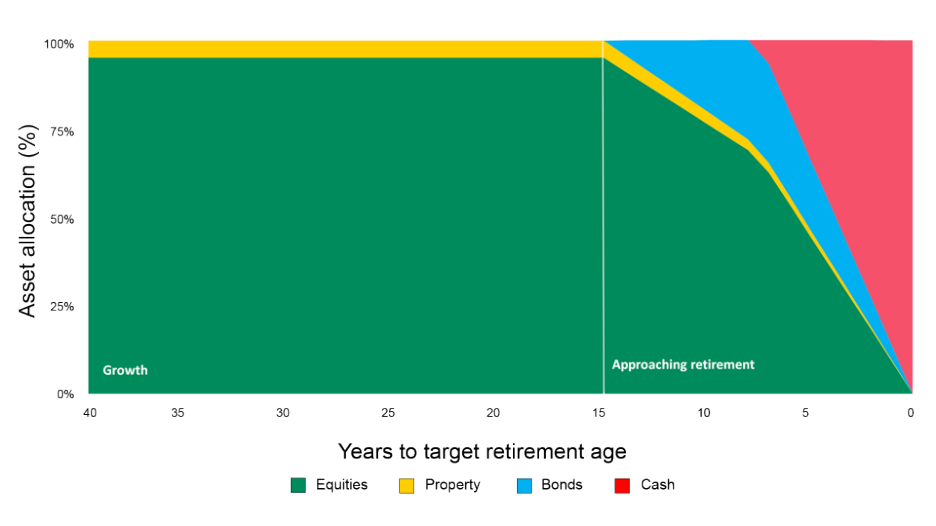

Aegon LifePath Capital is for members who intend to take their entire pension pot as a cash lump sum at retirement.

Early on, the fund invests 100% of savings in assets designed to grow a pension. 15 years before target retirement age, the fund automatically shifts to invest more in assets which are considered to be lower-risk, aiming to preserve the pot that has been built up. At retirement, the fund aims to hold around 100% in a cash fund.

The fund isn't designed for long-term investing post-retirement. The value of savings and any income isn't guaranteed and may fall as well as rise. The diagram below shows how the fund gradually changes its asset allocation.

Find out more

To find out more about LifePath please speak to your usual Aegon contact.