Anthony McDonald – Head of Portfolio Management

On 7 July 2025, the Risk-Managed Portfolios hit their five-year anniversary, and what an eventful five years it’s been. The traditional symbol for a five-year anniversary is wood, representing strength, stability, growth, and deep roots. A fitting analogy for our Risk-Managed Portfolios, which have demonstrated resilience through one of the most turbulent periods in recent history.

In summary:

- The WS Risk-Managed Portfolios have reached their five-year milestone, with over £800 million in assets under management

- Aegon’s first widely available OEICs fund range

- Delivered competitive performance in the face of a challenging market environment

- Long-term thinking and strategic asset allocations have driven returns

Investing in extraodinary times

Since the launch of the funds in July 2020, we've navigated an extraordinary period of global disruption. From a pandemic and a land war in Europe to the highest inflation rates in four decades across the UK and US, with the accompanying steep interest rate hikes. We’ve had unprecedented political turnover in the UK, with four Prime Ministers and five Chancellors. Meanwhile, the US implemented its highest tariff rates in nearly a century.

Throughout this instability, we’ve remained committed to our investment philosophy. Our disciplined approach to active asset allocation has delivered competitive performance, with outcomes aligned to fund objectives, all at an ongoing charges figure (OCF) of just 0.25%. We’ve gained over £800 million in assets under management and trusted by over 17,000 investors (as at 30/06/25).

As we reflect on the past five years, we do so with a sense of pride in what we’ve achieved and confidence in the strength of our process.

Strong performance rooted in valuation discipline

Over the five years to the end of July 2025, the funds have delivered competitive performance broadly in line with their benchmarks, while demonstrating greater resilience during the largest market downturns. This reflects the team’s disciplined approach to avoiding overvalued assets, a philosophy that has proven effective in mitigating losses during valuation corrections and in supporting a more stable return profile.

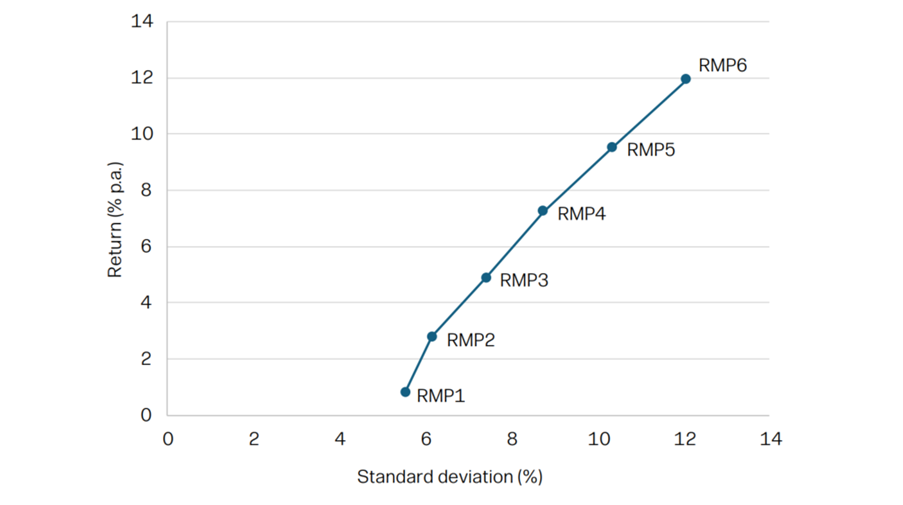

Five-year risk and return

Past performance isn’t a reliable guide to future performance. Source: Morningstar Direct, recreated by Aegon. Figures in £. Standard deviation (volatility) is annualised based on daily returns. Performance returns are cumulative, on a bid-to-bid basis net of fund charges with gross income reinvested from inception 31 July 2020 to 31 July 2025.

Key drivers of fund performance

In the first part of the period, the portfolios maintained a strategic underweight in bonds, particularly government bonds, in favour of cash. This positioning was driven by a clear-eyed view that low bond yields were unattractive amid rising inflation risks, fuelled by expansive fiscal and monetary stimulus. The approach was vindicated in 2022, when UK government bonds declined sharply. As valuations improved, the team responded with agility, gradually increasing exposure. By mid-2023, the portfolios had moved to an overweight position. While this has modestly impacted performance, particularly through long-dated gilts, it remains a high-conviction stance grounded in long-term value.

The portfolios have also maintained a consistent underweight in US equities. Although this positioning was a headwind during the AI-driven rally of 2023–24, the team’s commitment to valuation has begun to pay off. Following the re-election of President Trump, markets have recalibrated in response to his administration’s trade, tax, and immigration policies, introducing greater volatility and differentiation across global equities. This environment has favoured selective, valuation-aware strategies.

Elsewhere, the portfolios have leaned into opportunities in UK and Japanese equities, reflecting the team’s conviction in cheaper markets beyond the dominant US sphere.

Positioned for the long-term

With the continuation of challenges in investment markets, especially significant US policy changes and lingering uncertainty around future tariff levels, the portfolios continue to maintain a balanced asset allocation. Our portfolios are positioned to preserve capital and seek resilient returns by avoiding overvalued areas, maintaining a cautious stance on US equities, and favouring more attractively priced markets.

The portfolios maintain a strategic overweight in UK gilts, particularly long-dated issues, reflecting confidence that a softening labour market could support further rate cuts from the Bank of England later this year. In contrast, policy flexibility may be more constrained for the European Central Bank and US Federal Reserve, given persistent inflationary pressures linked to US fiscal policy and increased spending in Germany.

We believe the funds are differentiated by our focus on cheaper investments with healthy prospects and that this approach will stand the funds in good stead at a time of considerable policy change to which overpriced markets appear vulnerable.

Proven track record of performance and stability

Over a tumultuous five years for markets, our active asset allocation approach has helped drive strong performance across the funds, while maintaining volatility levels aligned with each fund’s objectives.

This active component gives us a competitive edge, enabling swift responses to unexpected market events, all at a highly competitive price point of a fixed 0.25% OCF.

We appreciate the trust investors have placed in us, and we‘re focused on building on this promising start to deliver attractive long-term investment returns.

If you’d like to know more about the Risk-Managed Portfolios, please get in touch with your Aegon contact or visit aegon.co.uk/adviser/risk-managed

Past performance isn’t a reliable guide to future performance. The value of investments can go down as well as up and your clients may get back less than they invest. Please refer to the fund factsheets for full fund details and fund-specific risks.

Opinions are based on the outlook of the Aegon UK Portfolio Management team and shouldn’t be interpreted as recommendations or advice.