Anthony McDonald – Head of Portfolio Management

July marked the three-year anniversary of our Risk-Managed Portfolios. A lot has happened over the last three years – a global pandemic, a land war in Europe, the highest rates of inflation in the UK and US for 40 years, and the steepest rises in interest rates for decades. The press has speculated as to whether 2020 was one of the worst times to launch a new fund, but we look back over the last 3 years with a sense of accomplishment. We’ve worked hard to navigate the funds through these unusual and uncertain times, acknowledging the complex backdrop while staying true to our investment philosophy:

- Markets aren’t fully efficient.

- A long-term view is crucial to successful investing.

- Starting valuations are a key determinant of long-term returns for equities and bonds.

- Asset allocation is an important driver of portfolio risk and return.

Reassuringly reliable during recent volatile times

The most material drivers of fund performance have been bonds and US equities.

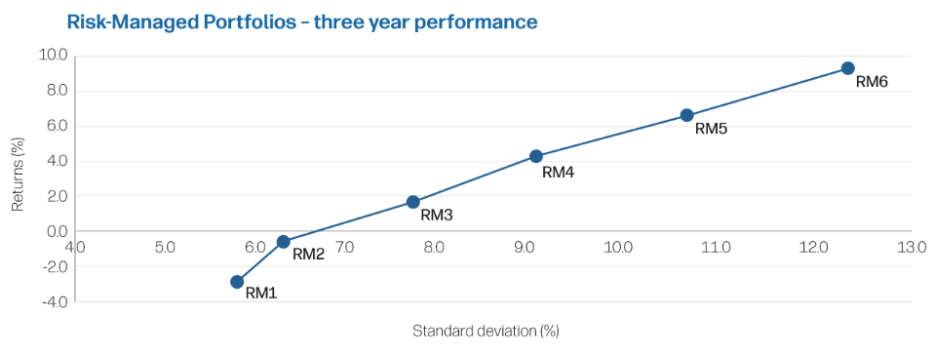

Four of the funds have outperformed over the period. LF Aegon Risk-Managed 1, LF Aegon Risk-Managed 2, LF Aegon Risk-Managed 3 and LF Aegon Risk-Managed 4 benefited from the bond positioning relative to the benchmark.

LF Aegon Risk-Managed 5 and LF Aegon Risk-Managed 6 moderately underperformed their benchmarks over the period. In keeping with their higher-risk approach, they’re mostly invested in equities and were held back to a greater degree by underweight positions in US equities.

Past performance isn’t a reliable guide to future performance. Source: Morningstar Direct, recreated by Aegon. Figures in £. Standard deviation is annualised based on daily returns. Performance returns are cumulative, on a bid-to-bid basis net of fund charges with gross income reinvested from inception (7 July 2020) to 7 July 2023.

Over most of the three-year period, the funds were positioned with an underweight in bonds, particularly government bonds, in favour of cash. This reflected the view that low bond yields were unattractive at a time when significant, combined fiscal and monetary stimulus contributed to rising inflation risks. The approach was very helpful as government bonds fell significantly in 2022.

Within equities, the US market has been a consistent underweight. Given its outperformance, this positioning has detracted from performance relative to the benchmark. For most of the period, the UK and Japanese markets were preferred although the UK position was phased out in the second half of 2022 as a position was gradually built in emerging markets.

A less-than-ordinary market backdrop – looking back at the last 3 years

Launching the funds during the COVID-19 pandemic meant that the initial backdrop was dominated by the battle against the virus and the significant challenges that it presented. Evidence of effective vaccines from November 2020 brought attention to the speed and sustainability of economic recovery, which proved to be significant despite uncertainty around new virus variants.

Substantial support measures remained in place during the 2021 recovery, including extremely low interest rates and high government spending. The stimulative effect of these policies alongside significant supply chain disruptions contributed to a surge in inflation in key developed countries over 2021-22. Central banks were initially confident that it would be a short-lived episode with Andrew Bailey, Governor of the Bank of England, noting in July 2021 that ‘it is important not to overreact to temporarily strong…inflation.’

However, price levels continued to rise in the second half of the year and central banks prepared to cut back the emergency stimulus policies that had been in place since the emergence of COVID-19. The situation was exacerbated by higher commodity inflation in the wake of Russia’s invasion of Ukraine in February 2022, setting the scene for steep and widespread interest rate hikes in 2022. Over the year, consumer price inflation (CPI) reached its highest level for more than 40 years in the US and UK at 9.1% and 11.1%, respectively. In the US, the Federal Reserve increased rates by 0.75% on four separate occasions, the largest increment since 1994. The European Central Bank raised interest rates for the first time since 2011, including the largest hike in their history.

Despite substantial policy tightening aimed at supressing inflation, the first half of 2023 was characterised by a re-acceleration in economic growth momentum in many regions. Consumer spending has been relatively resilient to higher interest rates as labour markets have remained tight in countries such as the US and the UK. In contrast, China’s economy has languished over much of the period amid prolonged COVID-zero policy, regulatory crackdowns, and property sector stress. The abrupt evolution of COVID policy in late 2022 spurred a rebound in economic activity but this proved short-lived.

A study in patience

Over the three years to 31 July 2023 global equity markets delivered healthy returns, benefitting from the global economic rebound following the COVID-19 downturn over the first part of the period. 2022 was more challenging for the asset class as interest rates rose but resilience in economic growth in many developed countries supported a rebound from late 2022.

US and UK equities outperformed over the three-year period. The US market came to the fore during the post-pandemic recovery, benefiting from a large weighting in technology-related names that could support changing work and lifestyle patterns. This market structure was helpful in 2023 when artificial intelligence was an important investment theme. Emerging markets were the main laggard amid disappointing economic performance from China.

In contrast to the equity market strength, bonds struggled against the backdrop of low starting yields, high inflation and rising interest rates. Government bonds fared particularly badly, with mainstream gilt (UK government bond) indices falling more than 30% over the period.

Positioned for the long-term

The portfolios continue to reflect a neutral conviction in equities, which seeks to balance elevated risks but pockets of reasonable valuation. At a time of economic risk and moderating valuations, the focus is on relative value opportunities, favouring more attractively valued markets where the policy backdrop appears more supportive. This leads to overweight positions in Japan and emerging markets, with an underweight in the US.

The government bond outlook has improved, leading to an upgrade in July to overweight conviction versus cash. The asset class also offers portfolio diversification at a time of high economic risks, as meaningful moderation in either economic growth or inflation should support government bonds.

Despite the recent underperformance of UK gilts, yields have risen to levels that appear attractive relative to other global government bond markets and the funds have moved to overweight. While corporate bonds may face risks from any slowing growth, current yield and spread levels support an overweight conviction in investment grade credit.

Although the last 3 years has been a real rollercoaster ride, our approach to active asset allocation has driven outperformance in most of the Risk-Managed Portfolios with a volatility outcome that’s in keeping with their objectives. The active asset allocation component, built in conjunction with Aon, gives us a competitive edge and allows us to act swiftly when unforeseen market events happen at a price point that is cost effective – a fixed ongoing charges figure (OCF) of just 0.25%.

We appreciate the trust that the funds’ investors have placed in us, and we‘re focused on building on this promising start to deliver attractive long-term investment returns, in what will hopefully be a less volatile period.

If you’d like to know more about the Risk-Managed Portfolios, please get in touch with your Aegon contact or visit aegon.co.uk/multi-asset.

Past performance isn’t a reliable guide to future performance. The value of investments can go down as well as up and your clients may get back less than they invest. Please refer to the fund factsheets for full fund details and fund-specific risks.

Opinions are based on the outlook of the Aegon UK Portfolio Management team and shouldn’t be interpreted as recommendations or advice.

Information correct as at September 2023. Link Fund Solutions Limited (LF) is the authorised corporate director of the Risk-Managed Portfolios. This means they’re responsible for the operation of the funds in accordance with the regulations.