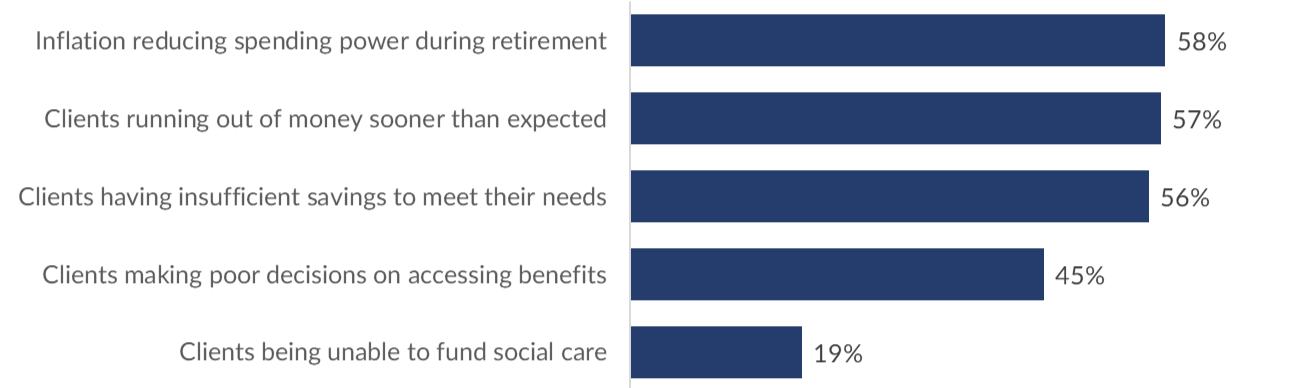

- Advisers’ top 3 most significant harms for clients in retirement: inflation reducing retirement spending power (58%), running out of money sooner than expected (57%) and having insufficient savings to meet their needs (56%)

- Demonstrates the value of advice to create a sustainable, resilient and tax-efficient retirement plan

Implementing the new Consumer Duty is probably the biggest regulatory change that advisers face this year. One of the FCA’s key expectations is that firms work proactively to avoid causing their clients foreseeable harm.

Retirement advice is one of the most complex areas of financial planning, with technical complexity around pension and tax rules, as well as lots of uncertainty around future income requirements, investment returns, trends in inflation and client lifespan. With so many uncertainties, there are many potential foreseeable harms, and it may be difficult to fully protect against all.

Research from Aegon* shows that advisers see the most significant foreseeable harms facing clients in retirement as: inflation reducing spending power (58%), running out of money sooner than expected (57%) and having insufficient savings to meet needs (56%). This was followed closely by making poor decisions on accessing benefits (45%) with being unable to fund social care (19%) also mentioned.

Aegon and NextWealth, Managing Lifetime Wealth, Q. In the context of the Consumer Duty, what do you see as the most significant foreseeable harms facing clients in retirement?

Avoiding foreseeable harms in retirement

In a pensions freedom world, clients have huge flexibility over how to draw their retirement income. This can deliver major benefits but also creates many risks to manage, or in Consumer Duty language, foreseeable harms. Advisers play a key role in explaining options and risks to their clients but have limited ability to remove them completely without predicting the future. Similarly, if a client reaches retirement with insufficient funds to meet their needs in retirement, there’s little an adviser can do to change the past, especially if the client comes to them later in life, but agreeing objectives and setting realistic expectations would help minimise the risk of running out of money.

But without advice, there is major risk of future harm. This demonstrates how important retirement advice is to build a retirement plan that’s sustainable, resilient and tax-efficient, helping clients to minimise or limit these harms.

Steven Cameron, Pensions Director at Aegon, comments:

“One of the most notable requirements in the FCA’s new Consumer Duty is firms acting to avoid causing customers foreseeable harm, and this is very important as well as complex for retirement advice.

“Advisers see the most significant foreseeable harms facing clients as the reduction of spending power due to inflation, exhausting money sooner than expected, or having insufficient savings to meet needs. Each of these risks are based on uncertain future events.

“It’s hard to avoid or mitigate all foreseeable harms because some conflict with one another. For example, being too cautious in protecting against running out of money may mean clients take less income than they could, limiting their ability to enjoy the early years of retirement. So it’s vital that advisers agree with clients which harms are most important to avoid, as well as documenting them all.

“As well as client circumstances and life expectancy, there is further uncertainty around the economic outlook. The number of potential harms and the way they can interact demonstrates the real value of advice at and in retirement.”

* Aegon research with NextWealth for the 2023 Managing Lifetime Wealth: retirement planning in the UK report. The latest research was conducted in November and December 2022 with 221 financial advisers and 209 consumers of retirement advice. Read more here: https://www.aegon.co.uk/advisers/advice-makes-sense/retirement-advice-in-the-uk-report.html

About Aegon

- In the UK, Aegon offers pension, investment and protection solutions to over 3.8 million customers. Aegon employs over 2,000 people in the UK and together with around 1,000 people employed by Atos, we serve the needs of our customers. More information: www.aegon.co.uk. Figures correct as at 31/12/2021

- Aegon UK is part of the wider Aegon Group, based in the Netherlands, whose roots go back to the first half of the nineteenth century. Since then, Aegon has grown into an international business, with over 31 million customers in multiple countries and EUR 1.02 trillion of revenue generating investments (as at 30/21/2021). More information on www.aegon.com.

The information in this press release is intended solely for journalists and shouldn’t be relied upon by any other persons to make financial decisions.