LifePath is a target-dated investment strategy that automatically manages a member’s savings from their early working life, through to retirement.

There are three LifePath strategies

Aegon BlackRock LifePath Flexi (default)

Aimed at members who intend to stay invested after they reach their target retirement age, with a view to taking income from their investments.

Aegon BlackRock LifePath Retirement

Aimed at members who intend to buy an annuity with their pension pot at retirement.

Aegon BlackRock LifePath Capital

Aimed at members who intend to cash in their entire pension pot at retirement.

Aegon BlackRock LifePath Flexi is the preferred default for TargetPlan and Aegon Master Trust schemes.

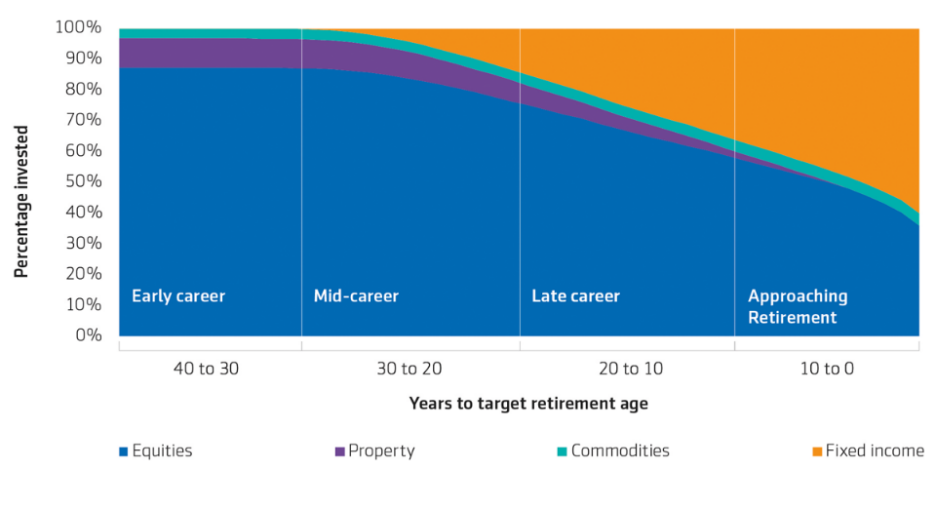

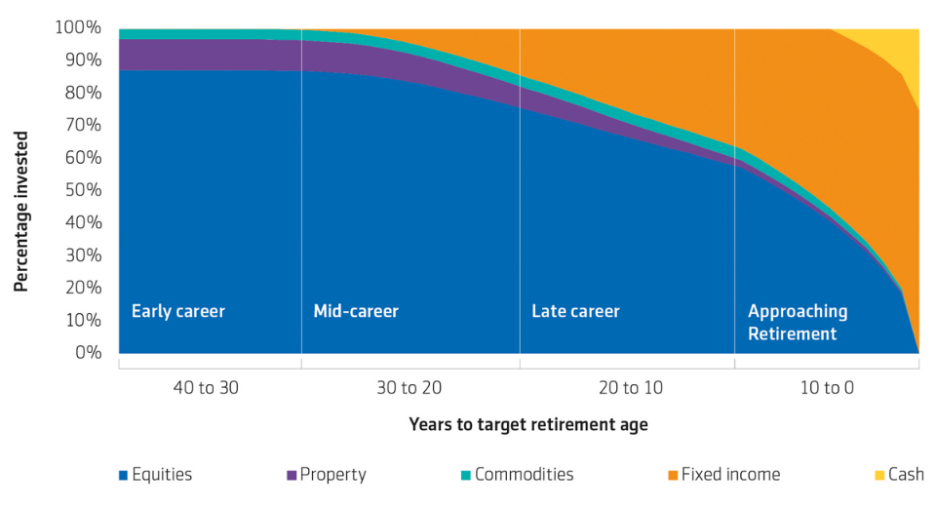

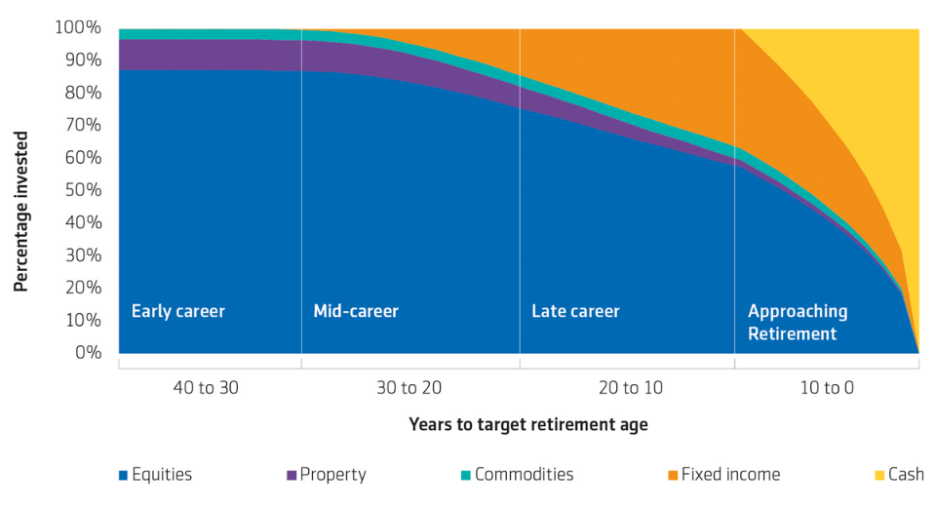

How LifePath works

Each of the LifePath strategies works in four broad stages. The funds invest in the same way for the early, mid and late career stages, but differ in the 10 years before retirement as they prepare savings for different retirement outcomes.

Early career

When members are still at the early stage of their career, the strategies focus on growth, investing largely in equities (company shares).

Historically equities have provided greater long-term growth potential than lower-risk asset classes, like fixed income securities (government and corporate bonds) or cash. But there’s no guarantee they will in future. The strategy takes this risk early on because members’ savings have time to recover from any market shocks, although there’s no guarantee.

92% of the assets in the fund consider responsible investment factors at this stage (as at 31 December 2023).

Mid-career

As members progress through their career, the strategies focus on building wealth by introducing greater diversification, combining growth assets (like equities) with investments designed to offer a degree of downside protection (like bonds).

Late-career

As members move towards retirement, the strategies still aim to offer growth but also to reduce the risk of savings falling sharply. By this stage, the equities proportion is much reduced as the strategies diversify away from higher risk investments and exposure to lower risk investments is increased.

Approaching retirement

In the 10 years before retirement the strategy gradually and automatically moves into historically less risky investment types, investing less in equities, and more in a mix of UK and overseas fixed interest securities. By retirement approximately 40% will be invested in global equities and 60% will be in fixed interest.

The fund will maintain the same 40%/60% mix into retirement and assumes members will want to remain invested and drawdown an income from their savings. We believe this mix provides a balance between risk and potential returns that can help guard against the effects of inflation, as well as supporting income withdrawals, although there’s no guarantee.

Around 44% of the fund considers responsible investment factors at this stage (as at 31 December 2023).

How the strategy changes as members approach retirement

In the 10 years before retirement the strategy gradually and automatically reduces the amount invested in equities and moves more into a mix of fixed interest securities and then cash.

This mix aims to ensure that, even if the value of a member’s retirement savings goes down just before they retire, the size of annuity they can buy should stay broadly the same, although this isn’t guaranteed. The cash element aims to provide for members 25% tax free cash allowance on retirement.

The strategy isn’t designed for long-term investing after members have retired. The ‘spending power’ of their retirement savings may be eroded by inflation if they leave it too long before they buy an annuity.

How the strategy changes as members approach retirement

In the 10 years before retirement the strategy gradually and automatically changes its focus to capital preservation.

This strategy isn’t designed for long-term investing after members have reached their target retirement age. The ‘spending power’ of their retirement savings may be eroded by inflation if they leave it there too long. Moving into lower risk investments could also mean they miss out on some growth if markets go up.

Any cash taken above 25% of their pension pot will be taxed as earned income.

How the strategy changes as members approach retirement

There’s no guarantee the fund will meet its objectives. The value of investments and any income taken, can fall as well as rise and isn’t guaranteed. The final value of a member’s pension pot when they come to take benefits may be less than has been paid in.

This information is based on our understanding of current taxation law and HMRC practice, which may be subject to change.

Why BlackRock?

BlackRock is one of the world's leading asset managers, providing investment solutions to institutions and financial professionals1. With over 19,000 employees, operating across 70 offices in over 30 countries around the world (as at 31 December 2023). BlackRock is focused on investing for the future and improving financial wellbeing for the people they serve, while also seeking to contribute to a more equitable and resilient world.

Investment stewardship is one of the ways in which BlackRock fulfills its fiduciary responsibilities as an asset manager. BlackRock Investment Stewardship serves as a link between those clients and the companies they invest in. The sole focus of BlackRock's dedicated stewardship team when they engage with companies or vote at shareholder meetings is to advance the financial interests of BlackRock's clients.

1Source: Business Insider 2024.

LifePath’s responsible investment credentials

Over recent years, we’ve worked closely with BlackRock to move assets in the LifePath default strategies into funds incorporating environmental, social and governance (ESG) screens. As at December 2023, over 90% of the LifePath strategy's investments incorporated these screens at the early years stage of investment.

We plan to increase these levels over the coming months and years, in line with the LifePath climate objective to target an absolute reduction of 50% in carbon emissions intensity by sales, over the 10-year period between June 2019 to June 20292. Significant progress has already been made towards this target with a 37% reduction in the carbon footprint of LifePath since 20203.

2LifePath target to reduce carbon emissions intensity by 50% by 2029, measured from a 2019 baseline and applies to scope 1 and 2 emissions from listed equities and corporate fixed income only.

3Source: Scope 1 and 2 carbon footprint calculated as tCO2e/£m invested using enterprise value including cash for listed equity and corporate fixed income as at 30th June 2023. Climate data is supplied by MSCI and based on reported, verified or estimated emission data. Climate data, metrics and methodologies continue to evolve and we expect that reporting frameworks will, in time, become standardised. As a result, reported information may be re-stated in the future as more and better climate data becomes available, in line with market best practice and regulations.

Find out more

To find out more about LifePath please speak to your usual Aegon contact.