If you don't choose where to invest your pension, you will automatically be invested in your scheme's default fund, the one your employer chooses for you. You also have the option to choose any of the LifePath funds through your TargetPlan or Aegon Master Trust pension scheme.

The Aegon BlackRock LifePath funds are what’s known as target dated funds. This means they automatically change what they invest in as you get closer to your selected retirement date. You’ll be put into a fund that includes the year you plan to retire in. So, for instance, if you’re retiring in 2035, you’ll be put into a fund that has 2034 – 2036 in its name.

You can find out which fund or funds you’re currently invested in, switch funds or change your retirement date by logging in to TargetPlan and selecting View and manage. It’s important to check, especially as you get closer to retirement, as you may find you want to take your retirement savings in a different way or at a different retirement age.

There are three LifePath funds:

Aegon BlackRock LifePath Flexi (default)

Suitable if you intend to stay invested after you reach your target retirement age, with a view to taking income from your investments.

Aegon BlackRock LifePath Retirement

Suitable if you intend to buy an annuity with your pension pot at retirement.

Aegon BlackRockLifePath Capital

Suitable if you intend to cash in your entire pension pot at retirement.

Aegon BlackRock LifePath Flexi is the preferred default for TargetPlan and Aegon Master Trust schemes.

How LifePath works

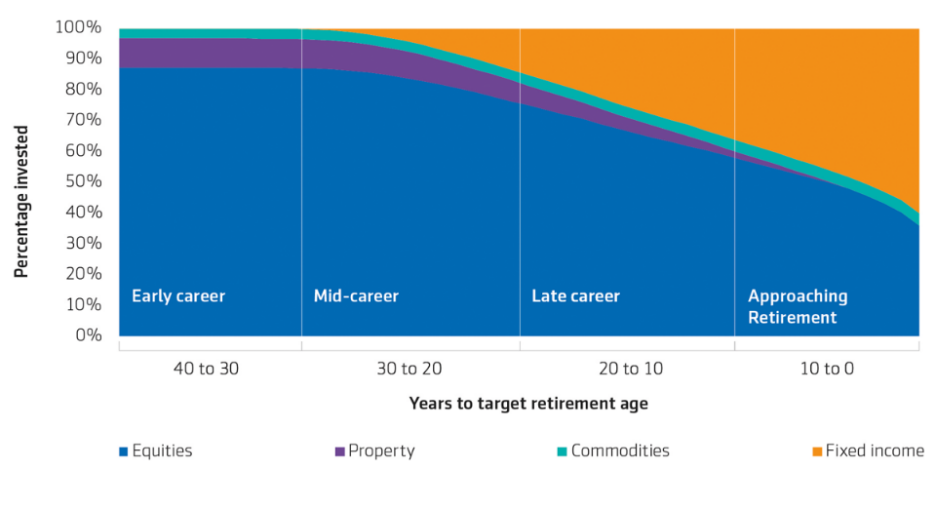

Each of the LifePath strategies works in four broad stages. The funds invest in the same way for the early, mid and late career stages, but differ in the 10 years before your target retirement date, as they prepare your savings for your selected retirement outcome.

Early career

During the early stage of your career, the strategies focus on growth, investing largely in equities (company shares).

Historically, equities have provided greater long-term growth potential than lower-risk asset classes like fixed income securities (government and corporate bonds) or cash. But there's no guarantee they will in future. The strategy takes this risk early on because your savings have time to recover from any market shocks, although again, there's no guarantee.

92% of the assets in the fund considers responsible investment factors at this stage (as at 31 December 2023).

Mid-career

As you progress through your career, the strategies focus on building wealth by introducing greater diversification, combining growth assets (like equities) with investments designed to offer a degree of downside protection (like bonds).

Late-career

As you move towards retirement, the strategies still aim to offer growth but also to reduce the risk of your savings falling sharply. By this stage, the equities proportion is much reduced as the strategies diversify away from higher risk investments and exposure to lower risk investments is increased.

Approaching retirement

We believe that most will value the flexibility that Aegon BlackRock LifePath Flexi offers. However, there are two other options. LifePath Retirement, suited to those targeting an annuity purchase and LifePath Capital, suited to those looking to cash in their pension. All three options are detailed further below.

In the 10 years before retirement the strategy gradually and automatically moves into historically less risky investment types, investing less in equities, and more in a mix of UK and overseas fixed interest securities. By retirement, approximately 40% will be invested in global equities and 60% will be held in fixed interest .

The strategy will maintain the same 40%/60% mix into retirement and assumes you will want to remain invested and drawdown an income from your savings. We believe this mix provides a balance between risk and potential returns that can help guard against the effects of inflation, as well as supporting income withdrawls, although there is no guarantee.

Around 44% of the fund considers responsible investment factors at this stage (as at 31 December 2023).

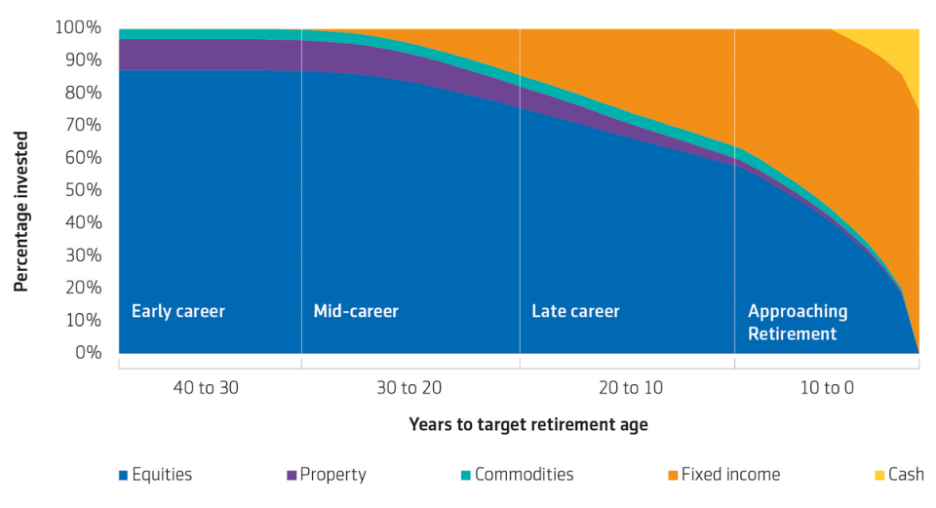

How the fund changes as you approach retirement

In the 10 years before retirement the strategy gradually and automatically reduces the amount invested in equities and moves more into a mix of fixed interest securities and then cash.

This mix aims to ensure that, even if the value of your retirement savings goes down just before you retire, the size of annuity you can buy should stay broadly the same, although this isn't guaranteed. The cash element aims to provide you with a 25% tax free cash allowance on retirement.

The strategy isn't designed for long-term investing after you have retired. The 'spending power' of your retirement savings may be eroded by inflation if you leave it too long before you buy an annuity.

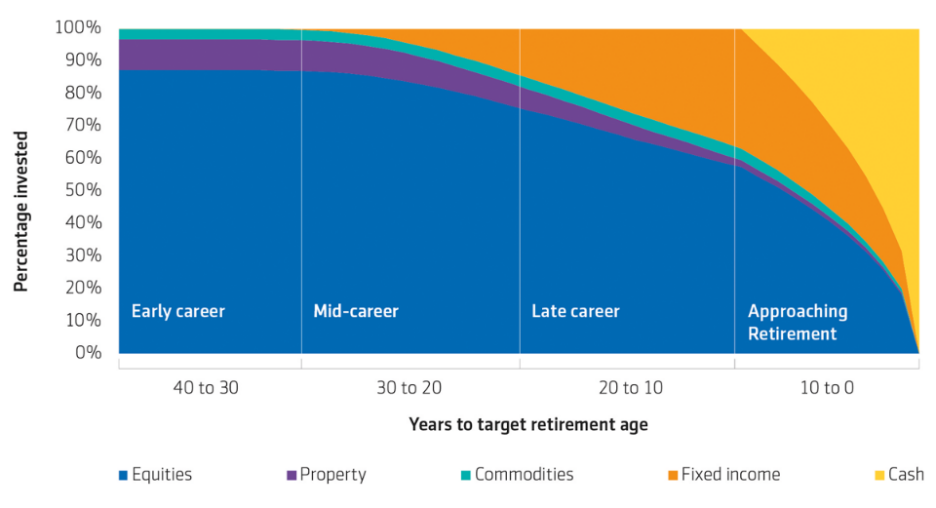

How the fund changes as you approach retirement

In the 10 years before retirement the strategy gradually and automatically changes its focus to capital preservation.

The strategy isn't designed for long-term investing after you have reached your retirement age. The 'spending power' of your retirement savings may be eroded by inflation if you leave it there too long. Moving into lower risk investments could also mean you miss out on some growth if markets go up.

Any cash taken above 25% of your pension pot will be taxed as earned income.

How the fund changes as you approach retirement

There’s no guarantee the fund will meet its objectives.

The value of investments and any income taken, can fall as well as rise and isn’t guaranteed. The final value of your pension pot when you come to take benefits may be less than you have paid in.

This information is based on our understanding of current taxation law and HMRC practice, which may change.

Why BlackRock?

BlackRock is one of the world's leading asset managers, providing investment solutions to institutions and financial professionals1. With over 19,000 employees, operating across 70 offices in over 30 countries around the world (as at 31 December 2023). BlackRock is focused on investing for the future and improving financial wellbeing for the people they serve, while also seeking to contribute to a more equitable and resilient world.

Investment stewardship is one of the ways in which BlackRock fulfills its fiduciary responsibilities as an asset manager. BlackRock Investment Stewardship serves as a link between those clients and the companies they invest in. The sole focus of BlackRock's dedicated stewardship team when they engage with companies or vote at shareholder meetings is to advance the financial interests of BlackRock's clients.

1Source: Business Insider 2024.

LifePath's responsible investment credentials

Over recent years we’ve worked closely with BlackRock to move assets in the LifePath default strategies into funds incorporating environmental, social and governance (ESG) screens. As at December 2023, over 90% of the LifePath's strategy's investments incorporated these screens in the early years stage of investment.

We plan to increase these levels over the coming months and years, in line with the LifePath climate objective to target an absolute reduction of 50% in carbon emissions intensity by sales, over the 10-year period between June 2019 to June 20292. Significant progress has already been made towards this target with a 37% reduction in the carbon footprint of LifePath since 20203.

2LifePath target to reduce carbon emissions intensity by 50% by 2029, measured from a 2019 baseline and applies to scope 1 and 2 emissions from listed equities and corporate fixed income only.

3Source: Scope 1 and 2 carbon footprint calculated as tCO2e/£m invested using enterprise value including cash for listed equity and corporate fixed income as at 30th June 2023. Climate data is supplied by MSCI and based on reported, verified or estimated emission data. Climate data, metrics and methodologies continue to evolve and we expect that reporting frameworks will, in time, become standardised. As a result, reported information may be re-stated in the future as more and better climate data becomes available, in line with market best practice and regulations.